Finnish marketers have been deprived of funds! One billion euros have disappeared since 2007. On average, 25 per cent has gone from the marketing budget of every single company in Finland. BUT, The entire billion has not been saved. We found a hidden half a billion invested in new marketing initiatives. Only a half of the total is missing, while the Finnish marketing statistics misplaced the rest.

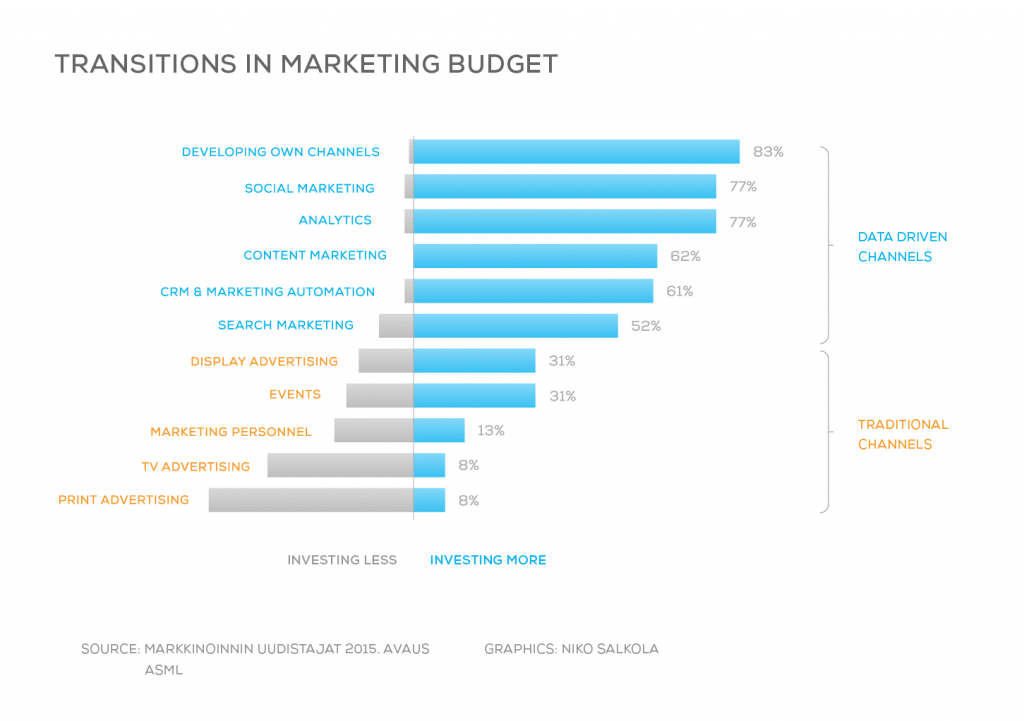

The dramatic cutbacks in traditional bought media have been counterbalanced by new budget items in which Finnish companies are now investing heavily. “The Reformers of Marketing 2015”, a survey conducted by Avaus and the Finnish Direct Marketing Association (ASML), indicates how companies are increasing spending in their own channels, social media marketing, analytics, content marketing, CRM and marketing automation. Cutbacks are mainly targeted at traditional bought media. Exhaustive statistics are compiled of the latter, not of the former. This blurs the picture of the Finnish marketing industry.

The new growing marketing investments have two things in common:

- They are investments in technology and data capabilities. The benefits are realised by leveraging new marketing technology combined with analytics.

- They enable the delivery of the right message to the right person at the right time, that is, to target groups of a single person. All these marketing investments contribute to the digitisation of the company. Media purchases have traditionally been outsourced to media agencies. Digital customer interactions are primarily managed in-house and usually with the help of technology and data owned by the company itself.

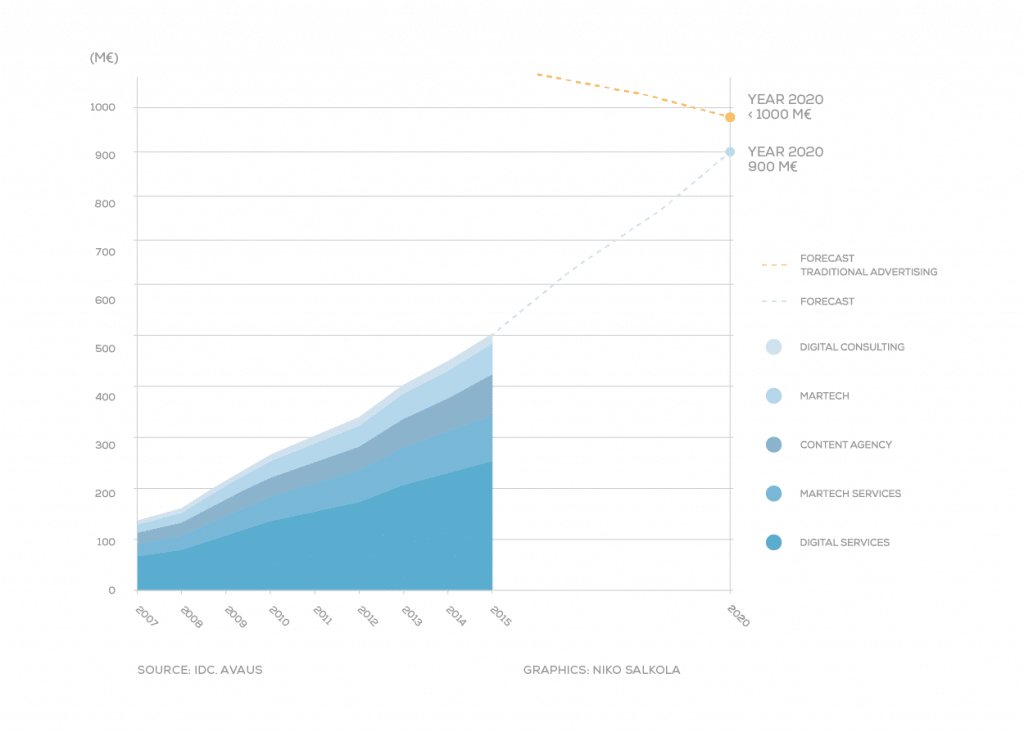

As we analysed the size and growth of these marketing investments, we stumbled upon 500 million euros, half of the EUR 1 billion that had gone missing! By combining surveys of IDC, a global market intelligence provider, and our own estimates, we discovered that the EUR 0.5 billion is annually spent on five different areas:

- Approximately EUR 250 million are invested in developing companies’ own channels, i.e. digital services.

- Some EUR 80 million is annually invested in marketing technologies.

- Investments of close to EUR 130 million are made in services related to the integration, development and operation of marketing technologies.

- Some EUR 80 million are spent on digital content and content marketing.

- Finally, approximately EUR 20 million is paid for digital marketing advisory services.

According to IDC estimates, 1.5 times higher than licensing costs should be allocated to marketing technology services. IDC has also predicted that marketing technologies will grow at an annual compound rate of 12.5%. Avaus estimates equally rapid growth in all of the other areas above. By 2020, these investments will have increased to EUR 900 million. If the decline in media advertising continues, its assets will fall below the threshold of EUR 1 billion at the same time. Therefore, marketing technology and related services investments will be on par with media advertising in 2020. These new marketing investments are mainly outside the scope of marketing industry statistics.

Who will get their slice of this newly discovered half a billion euros martech pie? Finnish media companies have merely received crumbs from the growing digital advertising spend.

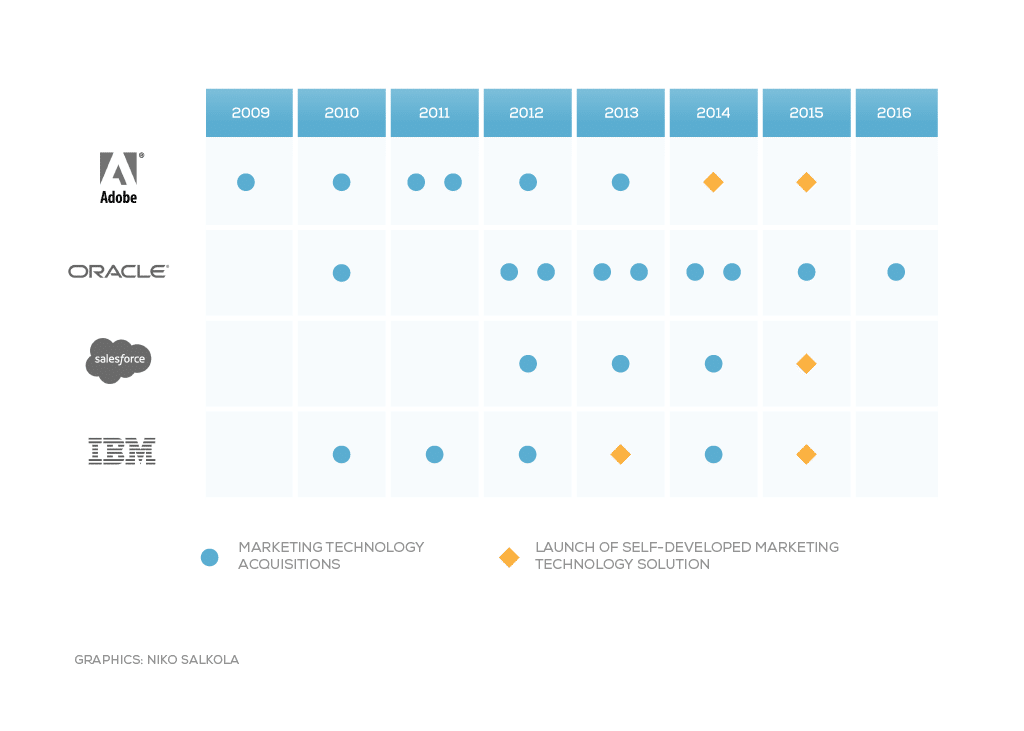

Today, four players dominate the enterprise marketing technology field: Adobe, Oracle, Salesforce and IBM. In recent years, these dominant technology giants have busily been building their marketing technology clouds through major technology acquisitions. In addition, Google recently released its heavy-duty service. It aims to expand from the advertising world it dominates to the marketing world, which has been the domain of other tech giants.

According to Gartner, Adobe is currently ahead of the pack when building a full-service marketing technology cloud. Salesforce and Oracle are fighting hard for second place. While the gap to IBM is a little wider, marketing technology forms part of the strategic change program of the technology giant. Its massive resources make it a serious contender.

Google, the King of digital advertising, is the new player on the field with its Analytics 360 Suite. It may well be a game-changer. The Premium version of Google Analytics is designed for larger businesses, and the Big Query is intended for handling big data. The toolbox will bring Google closer to a full-service marketing cloud. But Google is still missing the critical element, i.e. a marketing automation platform that constitutes the core of leading clouds. Email remains a significant marketing automation channel, especially when marketing is directed at companies’ customers. As this is a part of Google’s own backyard, we can expect new announcements at any time.

Large marketing clouds form marketing technology stacks, consisting of all key digital marketing platforms and applications. These are integrated into background enterprise systems. Marketing cloud vendors now promise one-stop-shop benefits to marketers. They also incentivise long-term commitments to one principal technology supplier.

A marketing technology stack can be compiled with individual, single-purpose marketing technology applications available by the thousands in the market. Companies opting for these should be prepared to allocate significant integration funds or settle for silos.

Right now, Finnish companies are facing major MarTech architecture decisions. As a result, many consider Chief Marketing Technologist roles in their marketing teams. Martech stack decisions are now pending for every marketeer who wants to stay competitive, regardless of industry and business size.

And here are the players that will benefit from the half a billion euros in marketing tech spend: EUR 250 million goes to tech companies focusing on developing digital services for corporates. Many players, from IT giants to smaller Drupal or WordPress shops, compete for the projects and consequent service agreement deals. A sixth of this lot is allocated to marketing technology suppliers, while a significantly larger portion is handed out to integrators and service providers of these technologies. Avaus belongs to this group and mainly competes with large vendors of competing technologies.

Finally, a notable portion is paid to content marketers that satisfy corporate websites’ nearly insatiable appetite for content. The most significant players seem to emerge from media companies that have reduced the size of their editorial organisations. Parts of these are now organised into content marketing units. Business intelligence providers, PR, and media agencies are also looking for a piece of the action. The smallest slice of the pie goes to a group of digital consultants that try to make sense of all this together with marketing executives.

Without blogging, marketing professionals need to keep up with the furious pace of marketing technology development. Marketing stack decisions are about to become more important than choosing the right media mix. Here at Avaus, we will continue blogging about all of this as well as hosting topical industry events. Please stay tuned!

Contact us